Here's why our clients love us

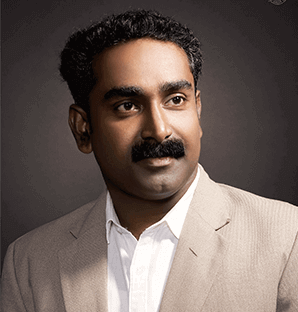

Randeep Sudan

Multivertz Pte. Ltd.

Bizpole is a company with great expertise in the domain of company incorporation and compliance. The company has a team of people who are highly cooperative and helpful.

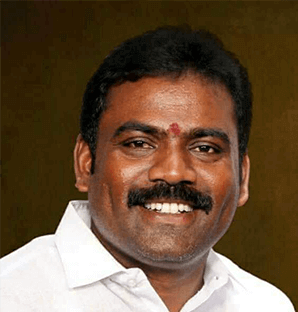

Aju K Rajan

Avizakta Enterprises

Thank you so much Bizpole Team for all the support and assistance in getting a trademark for my Cakeshop. I would recommend Bizpole to anyone without any doubt.

Navy George

Malayanma Vision

I had great service with Bizpole,Thanks for helping out with the registration. They have Affordable Prices and Great Customer Support. Truly a One Stop Solution for Business.

Kadavath Ahamed Reyas

Spice Producer Company

I had zero knowledge of procedures or the legal parts of LLP. Consulting Bizpole was one of the best decisions I took. From incorporation to IT filing operation, they helped me out with everything. I am thoroughly satisfied with their service.

Ahmed Mohiuddin

SDA SERVICES INIDA PVT LTD

I am happy to provide feedback on Vishnu and Naveena for their exceptional services. Both have demonstrated a high level of professionalism and dedication in their work. Their dedication and commitment to getting our company registered have been invaluable. Vishnu was always available to address any concems or questions | had, and he is proactive in identifying and resolving issues. Overall, lam extremely impressed vith the services provided by Vishnu and Naveena. They are both talented professionals who consistently deliver outstanding results, and | would highly recommend them to anyone seeking their services. Their contributions have been vital, and | look forward to continuing to work with ther in the future!

Anu Raag

Cute Voyages LLP

I would like to thank Hymavathi for completion of our work easily. Kudos for her sincerity in her work. I like the service of bizpole and explaining and responding for every queries, Thank you bizpole and Hymavathi

Gourav Yadav

RK Manufacturers

I have taken the Company Incorporation Registration from Bizpole Business Solution and other services also like Trademark and all and the whole team of Bizpole is very supportive and they did a great work and provided the best service. I especially want to thank Pinky who was the support from Bizpole Family. I am from Uttar Pradesh and this Bangalore based company provides everything on time. I am truly happy that | came across Bizpole Company. Thank you Pinky and Thank you Bizpole for taking my business to next level.

Harish Saras Vinayak

Vinayak Exports Private Limited

I am extremely satisfied with the exceptional service provided by Bizpole and their staffs especially Ms. Saranya supported and assisted me from the scratch til the end in obtaining all the required documents in the journey of registering my Textile Export business their expertise and dedication is truly amazing. i highly recommend their services to anyone in need. Thank you team , wish you reach more heights and actually really thanks Saranya for helping me in the process.

Mohammed Ajmal

EYECO

Professional services, timely responses approached for trademark registration staff named Asma done a great job and helped a lot to complete the processes. Thanks team bizpole.

Nilesh Kadam

Delpick

I am glad that I came across Bizpole solutions pvt ltd. for startup registration services. They are offering flexible schedule as well payment structure while servicing, Perfect for newly startup companies like me, and they have top notch advisor like NIKITA and Team.

Sanka Suresh

VSS Technologies

I took Trademark Registration services from Bizpole Business Solution they completed the work within the time as they said and they really given me a good information and given good suggestion also now I’m looking for more services which i want take by Bizpole only, because whole team of Bizpole is very supportive and they did a great work and provided the best service. I especially want to thank Asma K who is taking care of my cases from Bizpole Family. And they provide proper online service.

Tamil Arasi

Thanvitha Infra Projects Private Limited

I approached for a private limited registration. Saranya, the staff from Bangalore branch attended my queries with patience and she is so humble and kind. Because of her service it was easy for me to complete my process. I planned to continue being their customer and avail services.